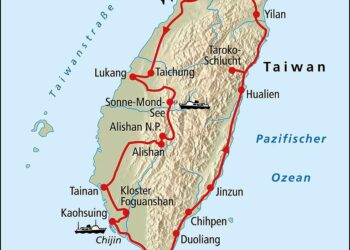

As the semiconductor industry continues to play a pivotal role in powering the modern economy, investors are increasingly turning their attention to key players in the market. Among these, Taiwan Semiconductor Manufacturing Company (TSMC) stands out as a leader in advanced chip production, servicing a wide array of sectors from consumer electronics to automotive technology. With recent fluctuations in stock prices and broader market dynamics, the question on the minds of manny investors is: should you buy TSMC stock at its current prices? In this article, we will explore the factors influencing TSMC’s market position, its financial health, and future growth prospects, providing an informed viewpoint to guide potential investors in their decision-making process. As we dissect TSMC’s strengths and challenges, we aim to equip you with the insights necessary to navigate this critical juncture in the semiconductor landscape.

Evaluating Taiwan semiconductor’s market Position and Competitive Edge

Taiwan Semiconductor Manufacturing Company (TSMC) holds a pivotal role in the global semiconductor industry,primarily due to its unmatched production capabilities and technological prowess.As the leading foundry, TSMC dominates a significant share of the market, serving a diverse clientele including tech giants like Apple, Nvidia, and AMD. Its competitive advantage stems from several key factors: cutting-edge technology, economies of scale, and strategic partnerships.Moreover, TSMC’s commitment to research and development ensures that it remains at the forefront of semiconductor innovation, continually refining its processes to produce smaller, more efficient chips.

The company’s robust financial health further strengthens its market position. With substantial revenue growth over the past few years, TSMC boasts a high profit margin compared to its competitors, enabling it to reinvest heavily in next-generation technologies.In addition, TSMC’s geographically diversified production facilities provide a hedge against supply chain disruptions, an aspect highlighted by recent global chip shortages. Investors should also consider the company’s expanding footprint in the semiconductor ecosystem, which is pivotal as industries like automotive and AI increasingly rely on advanced chip technologies. thus,while evaluating TSMC’s stock at current prices,its stable cash flow,remarkable market share,and innovation capability create a compelling case for potential buyers.

Understanding Recent Financial Performance and Earnings Trends

The recent financial performance of Taiwan Semiconductor Manufacturing Company (TSMC) presents a multifaceted picture that investors should carefully consider. For the latest fiscal quarter, TSMC reported a revenue increase of 5% year-over-year, driven by robust demand for advanced semiconductor technologies. Key factors contributing to this growth include:

- Increased demand from automotive and high-performance computing sectors.

- Expansion initiatives in the U.S. and other global markets.

- innovative product offerings in 5nm and 7nm process technologies.

Despite these positive indicators, the company’s earnings trends reveal a more cautious sentiment among analysts. TSMC’s net income margin has tightened, largely attributed to increased operational costs and global supply chain challenges.A summary of the latest earnings metrics is illustrated below:

| Quarter | Revenue ($ Billion) | Net Income ($ Billion) | Net Margin (%) |

|---|---|---|---|

| Q1 2023 | 17.6 | 6.9 | 39.2 |

| Q2 2023 | 18.0 | 7.1 | 39.4 |

Analysts project that the path forward will hinge on successfully navigating these cost pressures while capitalizing on growing sectors within the semiconductor market. Understanding these dynamics is essential for making informed decisions about investing in TSMC stock at current price levels.

Assessing Global Demand for Semiconductors and Future Growth prospects

The global semiconductor market is poised for significant expansion, driven by increasing demand across multiple sectors such as automotive, consumer electronics, and artificial intelligence. Analysts project that the semiconductor industry could grow at a compound annual growth rate (CAGR) of around 10-15% over the next five years. key factors influencing this growth include:

- Electrification of Transportation: The shift towards electric vehicles (EVs) requires advanced chip technology for battery management and sensors.

- 5G Network Rollouts: the deployment of 5G networks escalates the need for semiconductors in infrastructure and mobile devices.

- Increased Digital Change: businesses across sectors are investing heavily in cloud computing and data centers, which rely on high-performance chips.

Moreover, geopolitical factors and supply chain dynamics can impact the semiconductor landscape. The ongoing trade tensions and chip shortages may present both risks and opportunities for companies like Taiwan Semiconductor Manufacturing Company (TSMC). According to recent analyses, TSMC holds a commanding market share due to its cutting-edge technology and ability to meet the rising project demands efficiently. Below is a snapshot of the projected market segmentation by end-use in 2024:

| End-Use Sector | Market Share (2024) |

|---|---|

| Consumer Electronics | 35% |

| automotive | 25% |

| Telecommunications | 20% |

| Industrial | 15% |

| Others | 5% |

Analyzing Risks and Volatility in the Semiconductor Industry

As the semiconductor sector continues to experience unprecedented growth, investors must remain vigilant about the inherent risks and volatility that characterize this industry. Factors such as geopolitical tensions, supply chain disruptions, and rapid technological advancements substantially influence stock performance. as an example, with Taiwan Semiconductor Manufacturing Company (TSMC) being a pivotal player in the global supply chain, any instability in Asia can trigger fluctuations in stock prices. Additionally, shifts in consumer demand, especially in key markets such as automotive and consumer electronics, can lead to sharp changes in revenue expectations; thus, investors should closely monitor industry trends.

Moreover, the volatility in semiconductor stocks often stems from cyclical market conditions and the pressure of competing technologies. Investors should consider the following aspects when analyzing TSMC and similar stocks:

- Market Dependency: Heavy reliance on specific sectors can magnify risks.

- Global Competitiveness: The rapid emergence of competitors can affect market share.

- Regulatory Influences: Trade policies and tariffs can impact cost structures.

To provide a clearer picture of the current landscape, the following table highlights some of the key performance indicators for TSMC:

| Metric | Current Value | Previous Quarter |

|---|---|---|

| Revenue Growth | 15% | 10% |

| Gross Margin | 51% | 48% |

| Debt-to-Equity Ratio | 0.31 | 0.29 |

Investment strategy Recommendations for Potential investors

Investors considering Taiwan Semiconductor Manufacturing Company (TSMC) stock should evaluate several key factors that could influence their decision. The company has a strong market position as a leader in the semiconductor industry, thanks to its cutting-edge technology and strategic partnerships with global tech giants. Nonetheless, it’s essential to keep a close watch on market trends and shifts in demand for semiconductors, particularly with the upcoming innovations in artificial intelligence, automotive technology, and 5G capabilities. Here are some key recommendations:

- Diversify your portfolio: Don’t put all your eggs in one basket. Invest in a mix of sectors to mitigate risks.

- Monitor geopolitical factors: Keep an eye on taiwan’s political environment and trade relations,as these can significantly impact TSMC’s operations.

- Evaluate financial health: Look at TSMC’s financial statements, focusing on revenue growth, profit margins, and R&D investments to gauge its future prospects.

Additionally,it’s advisable to assess TSMC’s valuation metrics relative to its peers.currently, TSMC’s price-to-earnings (P/E) ratio may be seen as justified given its growth trajectory. However, investors should analyze trends in earnings forecasts and consider the potential for cyclicality in the semiconductor market. here’s a simplified overview of how TSMC compares against its closest competitors:

| Company | Market Cap (in billions) | P/E Ratio | Revenue Growth (YoY) |

|---|---|---|---|

| Taiwan Semiconductor | 600 | 30 | 15% |

| Samsung Electronics | 500 | 15 | 5% |

| Intel Corporation | 220 | 18 | -2% |

Exploring Expert Opinions and Analyst Ratings on Taiwan semiconductor Stock

As investors look towards the future of Taiwan Semiconductor Manufacturing Company (TSMC), a variety of expert opinions and analyst ratings emerge, offering insights into the stock’s potential trajectory. Analysts are currently mixed in their outlook, with some emphasizing the company’s dominance in semiconductor manufacturing and its critical role in powering modern technology. They highlight the following points:

- Market Leadership: TSMC’s commanding position in the foundry space, producing chips for major players like Apple and Nvidia.

- Innovation Pipeline: Continuous investment in cutting-edge technologies and capacity expansion in advanced nodes, driving future revenue growth.

- Resilience in Supply Chains: Effective management of supply chain constraints that have plagued the sector recently.

Conversely, some analysts express concern over potential risks, such as geopolitical tensions and the global semiconductor market’s cyclical nature. Key considerations include:

- Geopolitical Risks: Potential impacts from tensions between Taiwan and China, which could affect operational stability.

- Pricing pressure: Increased competition may lead to pricing pressures, impacting margins.

- Market Volatility: Broader market conditions could affect investor sentiment and stock performance.

| Analyst | Rating | Price Target |

|---|---|---|

| Goldman Sachs | buy | $120 |

| BofA Securities | Hold | $100 |

| Morgan Stanley | Buy | $125 |

To Conclude

the decision to invest in Taiwan Semiconductor Manufacturing Company (TSMC) at its current stock prices involves a careful consideration of various factors, including market trends, competitive landscape, and the company’s robust fundamentals. As the world continues to navigate through technological advancements and increasing demand for semiconductors, TSMC’s position as a leader in this critical sector cannot be overlooked.

For potential investors, it is essential to assess personal financial goals, risk tolerance, and market conditions before making a commitment. While TSMC presents intriguing opportunities, the semiconductor market remains volatile, influenced by both global economic shifts and geopolitical tensions. as always, consulting with a financial advisor and staying informed about industry developments is advisable before diving into any investment.

Investors considering TSMC should also keep an eye on upcoming earnings reports and strategic partnerships that may impact the stock’s trajectory. while TSMC holds promise,thorough due diligence and a complete understanding of the current landscape will equip you with the knowledge needed to make informed investment decisions.