in the ever-evolving landscape of global technology and finance, few companies have emerged as pivotal players in the semiconductor industry quite like Taiwan Semiconductor Manufacturing (TSM). As the largest semiconductor foundry in the world, TSMC has attracted significant attention from both investors and hedge funds, positioning itself as a cornerstone of modern electronic manufacturing. According to a recent analysis by Yahoo Finance, TSM has been identified as one of the best major stocks to consider for investment, thanks to its strategic innovations, robust financials, and critical role in the supply chains of leading technology firms.In this article, we delve into the reasons behind TSM’s increasing popularity among hedge fund managers and explore what makes this Taiwanese giant a compelling investment opportunity in today’s market.

Taiwan Semiconductor Manufacturing: A Pillar of the Global Economy

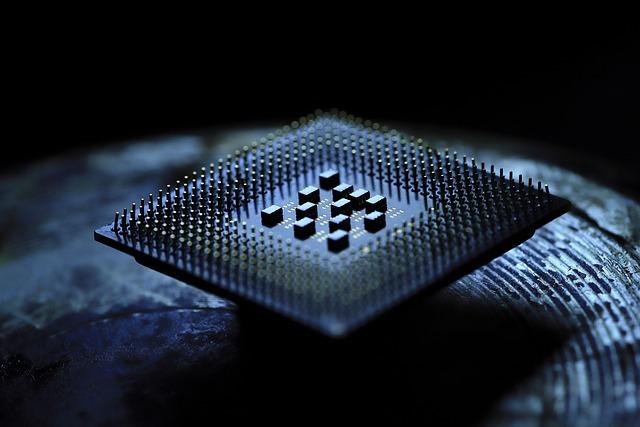

Taiwan Semiconductor Manufacturing Company (TSMC) stands as a critical component in the intricate web of today’s global economy. As the world’s largest contract chip manufacturer, TSMC produces semiconductors that power an array of devices, from smartphones to sophisticated data centers.Its role extends beyond mere manufacturing; TSMC is a driving force behind technological advancements that fuel industries such as automotive, healthcare, and artificial intelligence. The company’s state-of-the-art fabrication plants (fabs) and continuous investment in research and advancement enable it to stay ahead in a fiercely competitive market.

The implications of TSMC’s operations ripple throughout the supply chain and global markets. Major players in various sectors rely on TSMC for their semiconductor needs, creating a dependency that underscores the company’s importance. Consider the following factors driving TSMC’s centrality in the economy:

- Innovation: TSMC leads the industry with cutting-edge technology like 5-nanometer chips.

- Sustainability: Commitment to eco-pleasant practices in semiconductor manufacturing.

- Global Reach: Serving major tech giants like Apple, Nvidia, and AMD.

in essence, Taiwan Semiconductor Manufacturing is not just a stock investment; it represents a focal point of technological growth and economic stability, making it essential to both investors and the broader economy.

Hedge Fund Confidence: Analyzing Recent Institutional Investments in TSMC

Recent trends in institutional investments reveal a significant shift in hedge fund confidence towards Taiwan Semiconductor Manufacturing Company (TSMC).Manny leading funds have strategically increased their stakes, indicating a robust belief in the company’s long-term growth potential.This investment interest is underscored by TSMC’s pivotal role in supplying advanced semiconductor technology, which is increasingly vital for various industries, including automotive, consumer electronics, and cloud computing. Hedge funds recognize that TSMC is not just a player but a leader in the semiconductor sector, leveraging its cutting-edge fabrication capabilities to meet soaring global demand.

The following factors contribute to the heightened enthusiasm among hedge funds regarding TSMC:

- Technological Leadership: TSMC is at the forefront of semiconductor technology,consistently pushing the envelope with advancements like 5nm and the upcoming 3nm processes.

- Strong Financial Performance: The company has demonstrated impressive revenue growth and robust profit margins, making it an attractive option for long-term investment.

- Strategic Partnerships: Collaborations with major tech firms enhance its visibility and create a steady flow of orders, which hedge funds view as a low-risk opportunity in an or else volatile market.

| Institution | Stake Increase (%) | Quarter |

|---|---|---|

| ABC Capital | 35 | Q2 2023 |

| XYZ Investments | 27 | Q2 2023 |

| LMN Holdings | 50 | Q1 2023 |

Financial Performance: Understanding TSMC’s Revenue Growth and Profit Margins

Taiwan Semiconductor Manufacturing Company (TSMC) has demonstrated remarkable financial performance, characterized by steady revenue growth and impressive profit margins. Over the past few years, TSMC has capitalized on the increasing demand for semiconductor chips, driven by the explosion of technology sectors such as mobile devices, automotive electronics, and high-performance computing. In fiscal year 2022, TSMC reported revenue of approximately $63 billion, a testament to their dominant market position. Furthermore, the company continues to invest heavily in research and development, enhancing its ability to innovate and maintain a competitive edge.

Profit margins at TSMC reflect the company’s operational efficiency and strong pricing power in the semiconductor industry.With a gross margin hovering around 50%+, TSMC consistently outperforms many of its peers. This robust margin is attributable to a combination of cutting-edge manufacturing processes and a diverse customer base, ranging from consumer electronics to automotive giants. TSMC’s ability to maintain high gross margins while delivering value adds to its appeal as an investment opportunity.below is a summary table illustrating the recent financial metrics:

| Metric | 2022 | 2023 (projected) |

|---|---|---|

| Revenue | $63 billion | $70 billion |

| Gross Margin | 50%+ | Expected to Maintain |

| Net Income | $23 billion | $25 billion |

Market Dynamics: The Impact of Global Chip Demand on TSMC’s Business Model

The semiconductor industry is witnessing an unprecedented surge in demand, driven by the accelerating adoption of technologies ranging from artificial intelligence to electric vehicles. As the world increasingly relies on advanced chips for various applications, Taiwan Semiconductor Manufacturing Company (TSMC) stands at the forefront of this revolution. TSMC’s robust business model, which emphasizes cutting-edge research and development, allows it to cater to a diverse array of clients including major tech giants such as Apple and NVIDIA. This positions TSMC not only as a supplier but as a critical partner in innovation across several high-growth sectors.

To effectively navigate the fluctuating global chip demand, TSMC has adapted its production strategies and supply chain management. Key factors influencing its performance include:

- Technological Advancements: investment in next-generation nodes enhances efficiency and performance.

- Diverse Client Portfolio: Reducing reliance on any single customer mitigates risk.

- Geopolitical Considerations: Establishing resilient supply chains in response to global uncertainties.

Furthermore, TSMC’s commitment to sustainability and environmental duty enhances its reputation and appeal to socially conscious investors, making it a more attractive option in the eyes of hedge funds. As the demand for semiconductors remains strong, TSMC’s strategic approach to market dynamics positions it for sustained growth and profitability.

Future Outlook: Projections and Opportunities for Investors in TSMC

The global semiconductor landscape is poised for significant transformation, with TSMC at the forefront of this evolution. Analysts predict that the company will capitalize on several trends that will drive growth in the coming years. Some key factors influencing TSMC’s future include:

- Increased Demand for Advanced Chips: The ongoing shift toward more sophisticated technologies, including artificial intelligence and 5G, is expected to amplify the demand for TSMC’s advanced semiconductor manufacturing capabilities.

- Expansion of Fabrication Facilities: TSMC’s strategic plans to expand its manufacturing capacity, especially in locations like the United states, highlight the company’s commitment to meeting the surging demand.

- Partnerships with Leading Tech Companies: Collaborations with giants such as Apple and Nvidia are likely to bolster TSMC’s market position and facilitate technological advancements.

Investors should closely monitor these developments as they can translate into substantial returns. Notably, TSMC’s robust R&D investments are enhancing their competitive edge and will significantly shape market dynamics. A detailed outlook on projected financial performance indicates:

| Year | Projected Revenue Growth (%) | Market Share (%) |

|---|---|---|

| 2024 | 15 | 56 |

| 2025 | 18 | 57 |

| 2026 | 12 | 58 |

Such projections underscore a promising horizon for TSMC, suggesting continued growth and investment opportunities.By positioning itself effectively in emerging industries, TSMC is likely to foster an habitat ripe for investor participation.

Investment Strategies: Expert recommendations on buying TSMC Stocks

Investors looking to gain exposure to TSMC, a cornerstone of the semiconductor industry, should consider several strategic approaches. One recommended tactic is to adopt a dollar-cost averaging strategy, which involves buying shares at regular intervals, irrespective of the stock price. This method helps reduce the impact of volatility and ensures that investors accumulate more shares when prices dip.Moreover, maintaining a long-term outlook can be beneficial, as TSMC’s solid fundamentals and consistent demand for chips across various sectors underscore its potential for significant growth.

Hedge funds and analysts alike suggest analyzing key metrics before making a purchase decision. Tracking earnings reports, market trends, and insider transactions can provide valuable insights into TSMC’s performance.Moreover,it might potentially be prudent to monitor the company’s customer base which includes major tech firms relying heavily on TSMC’s advanced fabrication capabilities. Below is a quick overview of aspects to consider:

| Consideration | Importance |

|---|---|

| Earnings Growth | indicates company health |

| Market Demand | Reflects industry trends |

| Insider Holdings | Sign of confidence |

Key Takeaways

Taiwan Semiconductor Manufacturing (TSM) stands out as a compelling investment opportunity in the current financial landscape, especially as highlighted by the favorable sentiment from hedge funds. With its pivotal role in the global semiconductor market, TSM’s strong fundamentals and innovative capabilities position it strategically for sustained growth.As technology continues to drive demand for chips across a myriad of industries—from consumer electronics to burgeoning sectors like artificial intelligence and autonomous vehicles—investors may find TSM’s stock to be an attractive addition to their portfolios. As always, potential investors should conduct thorough research and consider market conditions before making any investment decisions. As hedge funds increasingly endorse this semiconductor giant, TSM’s potential for long-term success remains an intriguing prospect for investors looking to capitalize on the evolving tech landscape.