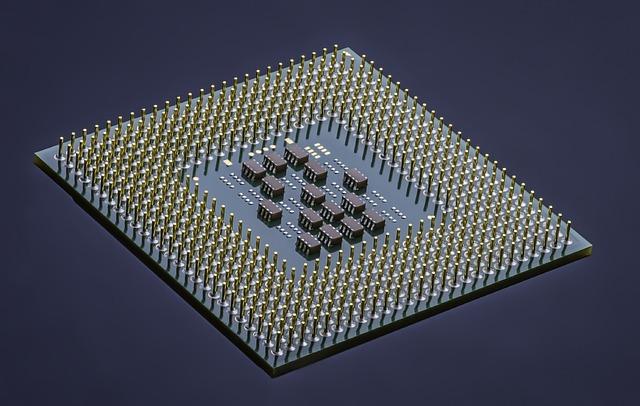

In an evolving landscape marked by geopolitical tensions and shifting trade policies, Taiwan Semiconductor Manufacturing Company (TSMC) finds itself at a crossroads. Recent threats of tariffs from the Trump administration have intensified the pressure on the world’s leading chipmaker, prompting discussions about potentially relocating its advanced packaging operations too the United States. As TSMC grapples with the implications of thes tariffs, the company faces a critical decision that could reshape its operational strategy and impact the global semiconductor supply chain. This article delves into the ramifications of the tariff threats,the strategic considerations at play,and what the potential shift in TSMC’s packaging capacity could mean for both the U.S. tech industry and the broader market dynamics.

Taiwan Semiconductor Faces Tariff Challenges Amid U.S. Trade Tensions

Taiwan Semiconductor Manufacturing Company (TSMC) finds itself navigating a turbulent landscape as U.S.-China trade tensions escalate, notably under the shadow of potential tariffs from the Trump administration. The implications of these tariffs could significantly impact TSMC’s operations and strategic decisions. With the U.S. goverment increasingly scrutinizing semiconductor supply chains for national security reasons, TSMC is considering shifting its advanced packaging capabilities closer to home. This move could mitigate the risks associated with tariffs while bolstering U.S. manufacturing, especially in response to the rising demand for cutting-edge technology.

As TSMC weighs its options, industry experts highlight several key factors in this evolving situation:

- Cost Implications: Increased production costs could arise from relocated manufacturing, raising concerns about passing on expenses to customers.

- Supply Chain Resilience: Establishing facilities in the U.S. may enhance supply chain security,reducing dependence on overseas operations.

- Collaboration Opportunities: A domestic presence could foster partnerships with American tech giants, potentially leading to innovative developments.

The potential shift in TSMC’s operational strategy serves as a pivotal moment for the semiconductor industry, underscoring the delicate balance between global trade dynamics and national interests.

The Implications of Advanced packaging Shifts for Global Supply Chains

The potential relocation of advanced packaging capabilities to the United States has notable ramifications for global supply chains, especially in the semiconductor industry. As geopolitical tensions rise and tariff threats loom, companies like Taiwan Semiconductor Manufacturing Company (TSMC) face increasing pressure to rethink their operational strategies. This shift could lead to a reconfiguration of manufacturing networks, with advanced facilities sprouting in North America to circumvent tariffs and optimize logistics. As a result, the landscape of global electronics supply chains could experience considerable disruption, affecting everything from sourcing materials to managing production timelines.

In light of these developments, stakeholders must evaluate the risks and opportunities associated with such a transition. the following factors may play crucial roles in how the supply chain adapts and evolves:

- Cost Management: Increased operational costs in the U.S. may influence pricing strategies.

- Skill Availability: The need for a skilled workforce in advanced packaging processes may drive new training initiatives.

- Innovation Acceleration: Proximity to leading tech firms in the U.S. could boost innovation through collaborative efforts.

- Supply Chain Diversification: Companies might seek to broaden their supplier base to mitigate risk.

This complex interplay of factors will ultimately define the next era of supply chain dynamics in the semiconductor sector, warranting keen attention from industry analysts and policymakers alike.By evaluating the strategic implications of these shifts, companies can better prepare for an evolving landscape marked by intensified competition and innovation.

Evaluating the Strategic Move to Increase Capacity in the United States

The strategic decision by Taiwan Semiconductor Manufacturing Company (TSMC) to potentially increase its operational capacity in the United States is swayed by several pressing factors. with the looming threats of Trump-era tariffs, the semiconductor giant is compelled to reassess its manufacturing landscape. By expanding capacity within U.S. borders, TSMC not only mitigates the risk associated with tariffs but also gains access to a key consumer market. This decision may reflect a pivot in global supply chains as companies seek to bolster domestic production capabilities, thereby ensuring a more resilient supply network in the face of geopolitical tensions.

The implications of this strategic move transcend mere tariff avoidance. A shift to American manufacturing has the potential to reshape how TSMC interacts with its customers and partners. Consider the following benefits that arise from escalating production capacity stateside:

- Reduced Supply Chain Risks: Lower dependency on overseas facilities enhances adaptability and responsiveness.

- Enhanced Collaboration: proximity to technology hubs fosters innovation and accelerates R&D efforts.

- Job Creation: Localized manufacturing could lead to significant employment opportunities across various sectors.

Potential Economic Impact of Tariff Pressures on Taiwan’s Semiconductor Industry

The persistent threat of tariffs poses a significant challenge for Taiwan’s semiconductor sector, an industry that has been a cornerstone of the global technology supply chain. As the U.S. government explores imposing additional tariffs on imported goods, Taiwanese manufacturers may face increased production costs, prompting companies to rethink their supply chain strategies. This shift could result in a domino effect, leading to potential increases in prices for consumers and businesses reliant on semiconductor products. The prospect of rising tariffs may force firms to consider relocating their advanced packaging operations to the U.S. to mitigate these pressures, which could foster local job creation but may also strain Taiwan’s economy in the long term.

In assessing the broader implications, the potential relocation of semiconductor capabilities could significantly modify the market landscape. The U.S. has been actively investing in domestic semiconductor manufacturing, aiming to reduce dependency on foreign sources. As Taiwanese companies weigh their options, they might prioritize strategic factors such as:

- Access to new markets in the U.S.

- Government incentives and support for local manufacturing

- Logistical advantages of operating nearer to major clients

- Reduced tariff exposure and better price stability

Moreover, while such a shift may alleviate immediate tariff pressures, it could also catalyze an accelerated arms race among global competitors, each vying for dominance in the semiconductor arena.The following table illustrates how some of the leading global semiconductor markets are reacting to the evolving trade landscape:

| Region | Response Strategy | Impact on Industry |

|---|---|---|

| U.S. | Increased domestic investment | Potential growth in local manufacturing jobs |

| Taiwan | Exploring collaboration and partnerships | maintaining global market share |

| China | Subsidizing local manufacturers | Strengthened capacity for self-sufficiency |

Policy Recommendations for Navigating Trade Risks in Semiconductor Manufacturing

As the semiconductor industry faces escalating trade tensions and potential tariffs, it becomes imperative to adopt strategic policies that minimize risks while fostering innovation and growth. One key proposal is to enhance domestic manufacturing capabilities through incentives and tax breaks aimed at attracting semiconductor firms to invest in local facilities. This proactive approach not only mitigates reliance on foreign supply chains but also strengthens national security and economic resilience. In addition, fostering partnerships between government agencies and private enterprises can facilitate knowledge transfer and support research initiatives, ultimately driving technological advancement within the industry.

Moreover, establishing a extensive trade policy that emphasizes collaboration with allies will be crucial in preserving market stability. Implementing bilateral trade agreements focusing on semiconductor technology can definitely help ensure equitable access and reduce the risk of sudden tariff impositions. Key actions include:

- Creating standardization protocols with partner countries to enhance compatibility and reduce friction in trade.

- Encouraging investments in R&D through public-private collaborations to spearhead innovations in semiconductor manufacturing.

- Developing educational programs aimed at building a skilled workforce capable of advancing manufacturing technology and practices.

Future Outlook for Innovation and Competitiveness in the Semiconductor Sector

As the semiconductor landscape continues to evolve under the pressures of geopolitical tensions and regulatory changes, companies in this space must adapt to stay competitive. The potential for shifts, such as moving advanced packaging capabilities to the U.S., presents both opportunities and challenges. Key factors influencing this transition include:

- Government Policy: Supportive measures and incentives from the U.S. government could catalyze investment in domestic semiconductor manufacturing.

- Supply chain Resilience: Diversifying production locations may enhance supply chain stability in the face of international disputes.

- Technological Advancements: Continued innovation in packaging technologies is critical for maintaining a competitive edge.

To further understand how these shifts might impact the semiconductor sector, it’s essential to consider the following illustrative data:

| Country | Current Market Share (%) | Projected Growth Rate (2025) |

|---|---|---|

| United States | 32% | 5.2% |

| Taiwan | 28% | 4.8% |

| South Korea | 20% | 3.5% |

| China | 15% | 6.1% |

Strategically, companies like Taiwan Semiconductor Manufacturing Company (TSMC) may need to recalibrate their operational frameworks and alliances. In this dynamic surroundings, fostering partnerships with local governments and tech firms within the U.S. could be vital for navigating the competitive landscape and ensuring sustained growth in an ever-changing global economy.

In Retrospect

Taiwan Semiconductor Manufacturing Company (TSMC) finds itself at a critical crossroads as it navigates the pressures of potential tariffs and geopolitical tensions fostered by past and present U.S. administrations. The discussion surrounding TSMC’s advanced packaging capacity highlights not only the intricate relationship between technology and international trade but also the implications for the broader semiconductor industry. With rising demands for chips and increasing scrutiny over supply chain security, TSMC’s strategic decisions could reshape the landscape of semiconductor manufacturing in the United States. As the industry continues to evolve under these external pressures, stakeholders will be keenly watching how TSMC responds to these challenges, balancing its operational capabilities against the backdrop of global economic dynamics. The outcome may well influence not only TSMC’s future but also the technological independence and competitiveness of the U.S. economy.