Introduction:

In a rapidly evolving financial landscape, where emerging markets often serve as the catalyst for economic transformation, Hela Cheikhrouhou stands out as a prominent figure steering investment initiatives across a diverse and dynamic region. As the Regional Vice President for the Middle East, Central Asia, Türkiye, Afghanistan, and pakistan at the International Finance Corporation (IFC), Cheikhrouhou is at the forefront of efforts to foster sustainable economic advancement and empower private sector growth. With her extensive experience in finance and development, she plays a pivotal role in bridging capital with possibility, navigating complex challenges, and unlocking potential in some of the world’s most promising yet underserved markets. This article delves into Cheikhrouhou’s impactful leadership, her vision for inclusive growth, and the strategic initiatives being implemented under her guidance to drive meaningful change in the region.

Hela Cheikhrouhou’s Vision for Sustainable development in Emerging Markets

Hela Cheikhrouhou envisions a transformative approach towards sustainable development that is intricately tied to the unique characteristics of emerging markets. By leveraging local resources and fostering inclusive economic growth, her strategy emphasizes the importance of collaboration among various stakeholders, including governments, private sector, and civil society. This multifaceted approach is designed to create a resilient framework that addresses critical challenges such as climate change, inequality, and economic diversification. The focus lies on implementing innovative financial solutions that not only drive investments but also ensure long-term sustainability in the regions she oversees.

To achieve these goals, Cheikhrouhou advocates for a robust framework that consists of the following key components:

- Investment in Green Technologies: Prioritizing renewable energy projects that can provide sustainable power while minimizing environmental impact.

- Capacity Building: Empowering local communities with the necessary skills and knowledge to support sustainable initiatives.

- Promoting Gender Equality: Ensuring equal participation of women in economic activities to enhance productivity and social equity.

- Access to Financing: Developing customized financing solutions to meet the unique needs of businesses operating in emerging markets.

By focusing on these areas, Cheikhrouhou aims to create a synergistic environment where economic growth dose not come at the expense of environmental and social sustainability, thereby setting a new standard for development in the regions served by the IFC.

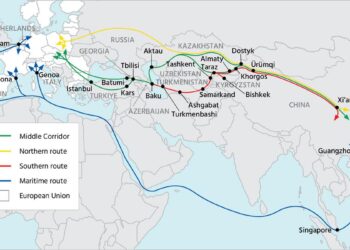

Navigating Economic Challenges in the Middle East and Central Asia

In a region characterized by rich cultural diversity and complex political landscapes,the challenge of economic stability is ever-present.As the global economy faces turbulence, the Middle East and Central asia are not immune to its effects. Factors such as fluctuating oil prices, geopolitical conflicts, and the impact of pandemic recovery efforts necessitate a multifaceted approach to navigating these turbulent waters. To address these challenges, regional policymakers and stakeholders must focus on strengthening local industries, encouraging investment in sustainable initiatives, and fostering public-private partnerships to create a more resilient economic framework.

Furthermore,innovation and technology play a critical role in enhancing economic diversification. Initiatives aimed at improving digital infrastructure, supporting start-ups, and developing skill sets for the workforce are vital components to empower local economies. A concerted effort to build a favorable business environment by implementing regulatory reforms and providing access to financing can unlock the potential of emerging markets in the region. The following table summarizes key action areas for addressing economic challenges:

| Action Area | Focus | Expected Outcome |

|---|---|---|

| Investment in Infrastructure | Modernizing transport and utilities | enhanced connectivity and efficiency |

| Strengthening SMEs | Access to capital and markets | Job creation and economic growth |

| Promoting Education | Developing vocational training programs | Skilled workforce for future demands |

Empowering Women Entrepreneurs: Key Initiatives by the IFC

In recent years, the International Finance Corporation (IFC) has taken a significant role in fostering women’s entrepreneurship in the Middle East and Central Asia. Targeted initiatives have been designed to enhance access to financing, boost leadership capabilities, and expand networks for women entrepreneurs.By focusing on both the challenges and opportunities, the IFC aims to close the gender gap in business ownership and economic participation. Through partnerships with local financial institutions, the IFC provides tailored financial products and capacity-building programs that empower women to turn their business ideas into viable enterprises.

To further support this mission, several key strategies have been implemented, including:

- Access to Finance: Offering specialized funds and loan guarantees aimed solely at women-led businesses.

- Training and Mentorship: Establishing programs that connect aspiring women entrepreneurs with experienced mentors in their industries.

- Networking Opportunities: organizing forums and workshops that enable women to build essential connections and share resources.

| Initiative | Description |

|---|---|

| Women in Business Program | Fosters entrepreneurship among women through financial and advisory support. |

| gender-Smart Investing | Encourages investments in businesses led by women or that focus on gender inclusion. |

Investment strategies for Resilient Infrastructure in Conflict-Affected Regions

In conflict-affected regions, the approach to infrastructure investment must prioritize resilience and adaptability. Investors shoudl focus on identifying projects that not only have immediate economic benefits but also bolster community stability. Key strategies include:

- Engaging local communities early to align projects with their needs and aspirations.

- Incorporating flexible design principles that can adapt to changing circumstances.

- Utilizing modular construction techniques that allow for rapid assembly and disassembly.

- Partnering with NGOs and humanitarian organizations to enhance project reach and impact.

To further ensure the sustainability of investments, establishing robust risk management frameworks is essential. This includes thorough assessments of geopolitical risks and market conditions. Essential components of such frameworks are:

| Component | Description |

|---|---|

| scenario Planning | Forecasting potential future scenarios to prepare for various outcomes. |

| Stakeholder Engagement | Building relationships with local stakeholders to foster trust and collaboration. |

| Diverse Funding Sources | Utilizing both public and private funding to mitigate financial risks. |

| Impact Assessment | Measuring social and economic impacts to ensure alignment with community needs. |

Fostering Public-private Partnerships to Drive economic Growth

The synergy between public and private sectors is a powerful engine for economic transformation. By harnessing their unique strengths, both sectors can create an ecosystem that fosters innovation, enhances competitiveness, and stimulates sustainable growth. As an example, governments can offer regulatory frameworks that incentivize private investment, while businesses can leverage their agility to respond quickly to market demands. The collaboration can manifest in various forms, such as:

- Joint Ventures: Combining resources to tackle major infrastructural projects.

- Investment in R&D: Collaborating on research initiatives that drive technological advancements.

- Skill Development Programs: Partnering to enhance workforce capabilities and education.

To illustrate the potential benefits of strategic alliances, consider the following table that outlines key sectors ripe for partnership opportunities:

| Sector | Potential Outcome |

|---|---|

| Renewable Energy | Increased investments in sustainable practices and job creation. |

| Healthcare | Expanded access to quality services and innovative healthcare solutions. |

| Technology | Enhanced digital infrastructure and improved services for citizens. |

By effectively leveraging these partnerships, countries can develop resilient economies that are well-equipped to navigate the complexities of the modern global landscape. It is imperative for stakeholders to engage in open dialogue, identify mutual benefits, and commit to long-term goals that prioritize collective advancement and societal welfare.

Building a Green Finance Framework for a Sustainable Future

Building an effective financial framework that prioritizes sustainability is essential for addressing the pressing environmental challenges of our time. Innovative financing mechanisms can play a pivotal role in facilitating investments into green projects. This encompasses a wide array of initiatives, from renewable energy and energy efficiency to sustainable agriculture and eco-friendly infrastructure. By aligning financial incentives with sustainable outcomes, financial institutions can drive significant investment towards sectors that contribute to a more resilient and sustainable future. This shift not only addresses climate change but also promotes economic growth and job creation.

One of the central components of a green finance strategy involves leveraging partnerships across different sectors to mobilize capital. Key stakeholders, including government entities, private investors, and civil society, need to collaborate in developing green bonds and other innovative financial products that can attract diverse investment sources. Furthermore, integrating ESG (Environmental, Social, Governance) criteria into investment decision-making is crucial. As the demand for transparency and accountability in investments grows, financial markets must adapt to ensure that sustainability is at the heart of their operations. The collective effort will contribute to building a robust green finance ecosystem that not only mitigates risks but also maximizes opportunities for a sustainable future.

Final Thoughts

Hela Cheikhrouhou’s impactful leadership at the International Finance Corporation underscores a pivotal era for the Middle East, Central Asia, Türkiye, Afghanistan, and Pakistan. Her commitment to sustainable economic development and financial inclusion resonates deeply within diverse sectors, driving innovative solutions and fostering growth in emerging markets. As the regional landscape continues to evolve, Cheikhrouhou’s vision and strategic initiatives position the IFC as a critical partner in advancing sustainable development goals across these regions. As we look toward the future, her work will undoubtedly leave a lasting imprint on the economic fabric of a region rich in potential and opportunity.