Introduction

As the world navigates a complex economic landscape shaped by evolving environmental,social,and governance (ESG) priorities,the financial sectors across Central and Eastern Europe (CEE),Central Asia,and Türkiye are poised for profound change. The “Bonds, Loans & ESG Capital Markets CEE, Central Asia & Türkiye 2025” conference seeks to unravel the meaningful opportunities presented by these changes, showcasing how regional markets are adapting to meet increasing investor demand for sustainable financing solutions. As traditional bonds and loans converge with innovative ESG frameworks, this event promises to illuminate the pathways for stakeholders in capital markets, fostering dialog around investment strategies that align profit with purpose.Industry leaders, investors, and policymakers will gather to explore the potential of the region in shaping a sustainable financial future, highlighting the critical intersection of economic resilience and responsible investment practices. join us as we delve into the future of capital markets, unveil emerging trends, and spotlight the pivotal role that CEE, Central Asia, and Türkiye will play on the global stage.

Understanding the Evolving Landscape of Bonds and Loans in CEE and Central Asia

As the financial landscape in Central and Eastern Europe (CEE) and Central Asia undergoes significant transformation, the dynamics surrounding bonds and loans are becoming increasingly complex. A growing emphasis on Environmental, Social, and governance (ESG) considerations is reshaping investor preferences, driving institutions to integrate sustainable practices into their financing strategies. This shift is not merely a trend; it is indeed redefining capital allocation within the region. As businesses engage in efforts to tackle climate change and social inequalities, they are harnessing bonds, particularly green and social bonds, to finance initiatives that resonate with socially conscious investors.

Moreover, the lending market is witnessing a rise in project finance and infrastructure development, spurred by government initiatives aimed at enhancing economic resilience and competitiveness. Key factors influencing this landscape include:

- Regulatory Frameworks: Innovations in legal structures are promoting a more conducive environment for bond issuance.

- Market Sentiment: The ongoing geopolitical shifts are influencing investor confidence and preferences.

- Technological Advancements: Fintech solutions are enhancing accessibility and efficiency in the debt markets.

In tandem with these developments, the demand for openness and accountability in financial reporting is rising, with corporations increasingly focusing on sustainability metrics to attract investment. As the region continues to expand its economic corridors, the synergy between traditional financing methods and innovative funding mechanisms will be crucial for sustainable growth.

The Role of ESG Criteria in Shaping Investment Decisions

Investment strategies in recent years have increasingly integrated environmental, Social, and Governance (ESG) criteria, reflecting a significant shift in how capital markets operate. These criteria not only serve as a lens through which to assess a company’s long-term viability but also highlight the associated risks and opportunities that can arise from sustainability practices. as investors become more socially conscious, they are keen to support organizations that prioritize ethical considerations alongside traditional financial performance. This development has led to a notable rise in the number of funds and investment vehicles focused on ESG compliance, illustrating the growing demand for responsible investment options.

The influence of ESG factors on investment decisions is also becoming apparent in regional markets such as CEE, Central asia, and Türkiye. Investors are now leveraging ESG metrics to identify and mitigate potential risks in their portfolios, which can range from regulatory changes to reputational damage. The following key elements of ESG criteria are becoming critical in shaping investment strategies:

- Environmental responsibility: Assessing a firm’s impact on the planet, including carbon emissions and waste management.

- social Impact: Evaluating a company’s labor practices, community engagement, and supply chain ethics.

- Governance Structures: Scrutinizing board diversity, executive compensation, and transparency in corporate governance.

Strategies for Navigating Market Volatility in 2025

As we look at 2025, market volatility requires investors to adopt proactive strategies to mitigate risks. Diversification remains a cornerstone of a robust investment approach. By spreading investments across various asset classes—such as equities, bonds, and real estate—investors can shield themselves from severe downturns in any single market segment. Another critical strategy is to maintain a liquid portfolio that allows for quick reallocations in response to market changes. Keeping a portion of assets in cash or cash-equivalents ensures readiness to seize new opportunities as they arise or to reduce exposure in declining sectors.

Furthermore, the integration of ESG principles into investment decision-making is gaining traction as a means of navigating volatility. Investors are increasingly recognizing the long-term financial benefits of supporting sustainable businesses, which frequently enough exhibit greater resilience during economic downturns. In addition, employing analytics for market sentiment analysis can provide valuable insights into potential market movements. By closely monitoring news cycles and social media trends, investors can make informed decisions that capitalize on emerging patterns, thereby enhancing their ability to respond effectively in turbulent times.

Best Practices for Issuers and Investors in Sustainable Financing

as the market for sustainable financing continues to grow, both issuers and investors must adopt certain crucial strategies to maximize the benefits of their engagements.For issuers, it is essential to clearly articulate the environmental, social, and governance (ESG) criteria underlying their projects. this includes providing transparent reporting and disclosures regarding impacts and progress towards sustainability goals. Issuers should also prioritize fostering relationships with a diverse array of investors who are aligned with their vision, ensuring a strong understanding of investor expectations and preferences.

Investors, conversely, should focus on conducting extensive due diligence when assessing sustainable finance projects.This means not only evaluating financial returns but also considering the long-term sustainability and ethical implications of investments. Building partnerships with educated issuers can enhance insight into the ESG landscape and help align investment strategies with evolving market demands. Moreover, investors are encouraged to actively engage with their portfolio companies, advocating for transparent practices that promote accountability in ESG reporting and performance.

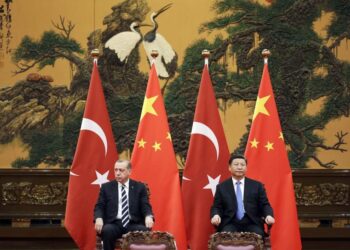

Key Opportunities in Türkiye’s Emerging Capital Markets

as global investors increasingly seek to diversify their portfolios, Türkiye’s capital markets present a tantalizing array of opportunities driven by strong economic fundamentals and a young, dynamic population. The ongoing reforms in regulatory frameworks and advancements in financial technology are enhancing market accessibility and efficiency, positioning Türkiye as a key player in the region. A few of the most compelling opportunities include:

- Green Bonds: With a growing focus on sustainability, Türkiye is poised to tap into the green finance market, attracting investment for renewable energy projects.

- Infrastructure Financing: The government’s commitment to improving infrastructure, particularly in transportation and energy, creates a solid foundation for bond issuances.

- foreign direct investment (FDI): with favorable demographic trends and a strategic geographical location, Türkiye continues to be an attractive destination for FDI, particularly in technology and manufacturing sectors.

- Emerging Market Debt: Investors can benefit from high-yield local currency bonds amid favorable economic indicators and a gradual stabilization of the lira.

Moreover, the convergence of traditional banking sectors with innovative fintech companies is reshaping capital market dynamics, leading to more efficient lending practices and expanded investment channels. The increase in ESG (Environmental, Social, Governance) awareness among investors also presents a unique opportunity for issuers who align their projects with environmental and social goals. Key sectors poised for growth include:

| Sector | Growth Potential | Investment focus |

|---|---|---|

| Renewable Energy | High | Solar and Wind Projects |

| Technology | Medium | Startups & Digital Transformation |

| Healthcare | High | Biotechnology & pharmaceuticals |

| Infrastructure | High | Transport & utilities |

Future Trends in Debt Instruments and Their Implications for Growth

The landscape of debt instruments is evolving rapidly, influenced by a multitude of economic, environmental, and technological factors. As the global economy seeks stability in the post-pandemic environment, we are witnessing a significant focus on sustainable financing strategies. The integration of Environmental, Social, and Governance (ESG) criteria into bond issuance is reshaping investment paradigms, appealing to a growing class of socially conscious investors. This shift not only reflects a commitment to broader societal goals but also signals a reallocation of capital towards more sustainable projects, which in turn is highly likely to support long-term economic resilience and growth. Key trends to watch include:

- green Bonds: Increasing issuance dedicated to renewable energy projects.

- Social bonds: Financing initiatives aimed at improving social welfare.

- Digital Debt Instruments: The emergence of blockchain-based solutions for greater efficiency.

Moreover, evolving regulatory landscapes across CEE, Central Asia, and Türkiye are likely to encourage diverse debt offerings. The move towards yield enhancement strategies in traditional fixed-income securities will present opportunities for issuers and investors alike. The recent uptick in partnerships between private and public sectors indicates a commitment to innovate while addressing local needs. Moreover, emerging markets may benefit from competitive advantages through the introduction of tailored debt solutions, designed to attract foreign investment while addressing domestic challenges. A summary of potential impacts includes:

| Impact Area | Potential Outcomes |

|---|---|

| Sustainable Investment Growth | Increased capital allocation to ESG-compliant issuances. |

| Regulatory Adaptations | Streamlined processes for green and social bonds. |

| Technological integration | Enhanced transparency and efficiency in the issuance process. |

To Conclude

As we look ahead to the “Bonds, Loans & ESG Capital markets CEE, Central Asia & Türkiye 2025″ event, it’s clear that the landscape of financing in these regions is poised for transformation.The convergence of traditional bond markets with innovative loan structures and the growing demand for sustainable finance solutions underscore the shifting priorities of investors,issuers,and financial institutions alike.The integration of Environmental, Social, and governance (ESG) principles into capital markets is no longer a niche consideration; it has become a essential aspect of strategic planning for businesses and governments.As we engage with industry leaders, policymakers, and financial experts at this pivotal event, the discussions surrounding sustainable investment, infrastructural advancements, and inclusive economic growth will be more critical than ever.

In the coming years,Central and Eastern Europe,along with Türkiye and central Asia,will undoubtedly play a vital role in reshaping the global financial narrative. As these regions continue to navigate the complexities of their respective markets, the emphasis will remain on fostering collaboration and innovation to drive economic resilience.

Stay tuned as we cover these developments and provide insights that will shape the future of bonds, loans, and ESG capital markets. The opportunities are immense, and the journey towards sustainable finance is just beginning.