Welcome to Equity Capital Markets CEE, Central Asia & Türkiye 2024: A Focus on Bonds and Loans

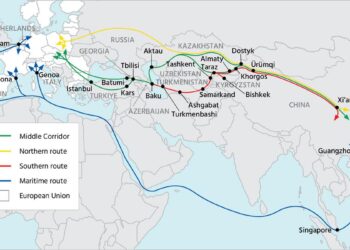

As the global financial landscape continues to evolve, the Central and Eastern European (CEE) region, along with Central Asia and Türkiye, is emerging as a pivotal hub for innovative financing opportunities. The upcoming 2024 edition of the “WELCOME TO EQUITY CAPITAL MARKETS CEE, CENTRAL ASIA & TÜRKİYE” conference is set to illuminate the dynamic interplay of bonds and loans within these markets, showcasing the resilience and growth potential of participating economies. With a diverse array of stakeholders,including investors,issuers,and policymakers,this event will delve into the strategies driving capital flows and investment in an era marked by geopolitical shifts and economic recovery. Attendees can expect insightful discussions on market trends, regulatory developments, and the challenges and opportunities presented by evolving fiscal frameworks. Join us as we explore the integral role that bonds and loans will play in shaping the financial future of these vibrant territories.

Understanding the Current landscape of Equity Capital Markets in CEE, Central asia and Türkiye

The equity capital markets (ECM) across Central and Eastern Europe, Central Asia, and Türkiye are experiencing a dynamic evolution, reflecting both regional economic shifts and global market trends. countries in this area are witnessing increased investor interest, driven by their expanding middle classes and a surge in digital transformation across various sectors. Key factors influencing this landscape include:

- Regulatory Developments: Enhanced frameworks aimed at attracting foreign investments.

- Technological Innovation: Growth in fintech solutions facilitating market access.

- Economic Recovery: Post-pandemic rebounds leading to greater capital raising activities.

Moreover, the geopolitical landscape continues to shape investor sentiment. As a notable example, while Türkiye stands out with its strategic location bridging Europe and Asia, countries in Central Asia are becoming increasingly appealing due to their rich natural resources and untapped markets. Recent data highlights key ECM milestones:

| Country | 2023 ECM Activity ($ Billion) | notable IPOs |

|---|---|---|

| Türkiye | 7.5 | ABC Corp, XYZ Holdings |

| poland | 4.3 | DEF Industries |

| Kazakhstan | 2.1 | GHI Resources |

As companies in these regions position themselves for growth, ongoing investment in sustainable practices and adherence to global ESG (Environmental, Social, and Governance) standards will likely enhance their appeal to international investors. Therefore,understanding the intricacies of the ECM in these emerging markets is crucial for stakeholders looking to navigate opportunities and potential risks effectively.

Key Trends Shaping Bond and Loan Markets in 2024

As we navigate through the complexities of global finance in 2024, several key trends are emerging in the bond and loan markets, shaped by a mix of economic recovery, inflation pressures, and shifting investor behaviors. Central banks are gradually adjusting their interest rate stances, moving towards a more cautious approach, which will influence pricing and issuance dynamics in these markets.The continued interest in green bonds and sustainable investments is also expected to gather momentum, driven by heightened awareness of climate change and the commitments made during various international summits. Investors are increasingly prioritizing Environmental, Social, and Governance (ESG) criteria, resulting in a surge in demand for securities tied to social impact initiatives and green technologies.

Moreover, geopolitical tensions and economic uncertainties will remain at the forefront, leading businesses to reconsider funding strategies for their projects. The inclination towards private placements and direct lending as alternatives to public debt markets is growing, enabling companies to secure more tailored financing options. Key characteristics of the evolving market landscape include:

- Increased Volatility: Investors should brace for fluctuations driven by external economic factors.

- Shorter Duration Debt: Issuers may favor shorter-term bonds to mitigate interest rate risks.

- Technological Transformation: The rise of fintech solutions will simplify accessing capital and enhance transparency.

| trend | Impact |

|---|---|

| Green Bonds Boom | Increased funding for sustainable projects |

| Rising Interest Rates | Corporate refinancing challenges |

| Shift to Private Debt | more customizable funding solutions |

Investment Strategies for Navigating emerging Opportunities

As the global landscape continues to evolve, investors are increasingly faced with a myriad of emerging opportunities, especially in the realms of debt markets and high-yield instruments across Central and Eastern Europe, Central Asia, and Türkiye. To effectively navigate these complex waters, it is essential to adopt adaptable investment strategies that leverage local insights and market trends. Key tactics may include:

- Diversification: Spreading investments across various sectors and regions to mitigate risks.

- Due Diligence: Conducting thorough research into market dynamics and regulatory frameworks.

- Stakeholder Engagement: Building relationships with local partners and governmental bodies to enhance investment resilience.

the potential for favorable returns is notable,especially when focusing on sectors like renewable energy,technology,and infrastructure. Investors may also look to specific financing structures that can maximize liquidity and capital efficiency, such as:

| Financing Structure | Description |

|---|---|

| Sukuk Bonds | Sharia-compliant alternatives offering attractive yield opportunities. |

| Green Bonds | Investment in environmentally sustainable projects with growth potential. |

| Syndicated Loans | collaborative financing mechanisms that distribute risk among multiple investors. |

By applying these strategies and identifying promising sectors, investors can enhance their potential for success in an increasingly interconnected market. Understanding regional nuances and maintaining versatility will be crucial in capitalizing on these emerging opportunities, allowing for effective risk management and optimized returns.

Risk Factors and Mitigation Approaches for Investors

Investors considering opportunities in Central and Eastern Europe, Central Asia, and Türkiye must navigate a landscape shaped by various risk factors.Key concerns include political instability, economic volatility, and currency fluctuations. Political uncertainty, particularly in regions with ongoing conflicts or governance issues, can severely impact market performance. Additionally, fluctuating commodity prices may create economic challenges, making it essential for investors to stay informed about changes in local and global economies. Exchange rate risks are also pertinent,especially for those investing in bonds and loans denominated in foreign currencies. The following factors should be closely monitored:

- Regional conflicts potentially affecting trade routes and investor confidence.

- Economic sanctions that could hamper financial transactions and disrupt business operations.

- Inflationary pressures leading to reduced purchasing power and increased cost of living.

To mitigate these risks,investors should adopt a strategic approach that includes diversification of investments,thorough due diligence,and active monitoring of market conditions. By diversifying across various sectors and regions, investors can reduce their exposure to region-specific downturns. Conducting detailed analyses of potential investment projects, including risk assessments and financial viability studies, can provide deeper insights. Furthermore, maintaining a close watch on economic indicators and geopolitical developments enables investors to react swiftly to any emerging threats. The table below highlights some potential mitigation strategies:

| Strategy | Description |

|---|---|

| Portfolio Diversification | Spreading investments across different assets to minimize risk. |

| Regular Market Analysis | Continuous review of economic indicators and trends. |

| political Risk Insurance | Purchasing insurance to protect against losses from political events. |

The Role of Regulatory Changes in Market Dynamics

The financial landscape in Central and Eastern Europe, Central Asia, and Türkiye is constantly evolving, with regulatory changes at its core shaping market dynamics. Adjustments in legislation can either stimulate growth or impose constraints, substantially influencing investor behavior and the flow of capital. As countries seek to enhance their attractiveness to foreign investors, manny are reforming their regulatory frameworks. This includes streamlining processes, protecting investor rights, and providing clear guidelines for public offerings and bond issuances.

Furthermore, key trends emerging from these regulatory shifts include:

- Increased transparency: Governments are adopting measures to ensure financial disclosures are clearer and more extensive.

- Stability in investment environments: Proactive regulatory revisits are aimed at mitigating the risks associated with political and economic fluctuations.

- Encouragement of innovation: New regulations surrounding fintech and green bonds are paving the way for broader investment opportunities.

As these changes unfold, market participants must remain vigilant and adapt their strategies accordingly, ensuring they capitalize on the emerging opportunities while navigating possible challenges posed by new regulatory standards.

Looking Ahead: Predictions for Growth in 2024 and Beyond

As we cast our gaze toward 2024 and the ensuing years, the financial landscape in Central and Eastern Europe, central Asia, and Türkiye is poised for notable growth. The anticipated recovery and expansion of economies in these regions will be significantly influenced by strong domestic demand, increased foreign investment, and strategic government initiatives aimed at fostering innovation and infrastructure development. Emerging sectors such as technology, renewable energy, and sustainable finance are expected to gain considerable traction, further driving capital market dynamics.

Key trends to watch include:

- Resilience of Local Markets: With ongoing structural reforms, local companies will likely see enhanced access to capital through bonds and loans, fostering a robust environment for corporate growth.

- Increased ESG Focus: Environmental,Social,and Governance criteria will shape investment decisions,leading to a surge in green bonds and socially responsible investment opportunities.

- Digital Transformation: The integration of advanced technologies in banking and finance will streamline operations and enhance customer experiences,positioning regional markets favorably in the global arena.

| Trend | Impact on Capital Markets |

|---|---|

| Resilience of Local markets | Boost in corporate bond issuances and loan accessibility |

| Increased ESG focus | Growth in innovative financing products |

| Digital Transformation | Enhanced operational efficiency and investment reach |

In Summary

as we look ahead to the insights and opportunities presented at the “WELCOME TO EQUITY CAPITAL MARKETS CEE, CENTRAL ASIA & TÜRKİYE 2024 – Bonds and Loans” conference, it is clear that the landscape for investment in these regions remains dynamic and full of potential. The convergence of diverse economies, evolving regulatory environments, and increasing investor interest signals a robust future for equity capital markets.

This event will bring together thought leaders, market participants, and policymakers, fostering discussions that will shape the trajectory of capital flows and investment strategies across Central and Eastern Europe, Central Asia, and Türkiye. By addressing the challenges and harnessing the opportunities that lie ahead, stakeholders can pave the way for sustainable growth and innovation in the capital markets.

As we prepare for a year marked by strategic partnerships and transformative developments, it is crucial for investors and businesses alike to remain informed and engaged.the discussions that will unfold at this conference are poised to provide invaluable insights and set the stage for the next chapter in equity capital markets for the region. We invite you to join us in embracing the future of investment as we navigate the bonds and loans landscape together in 2024 and beyond.