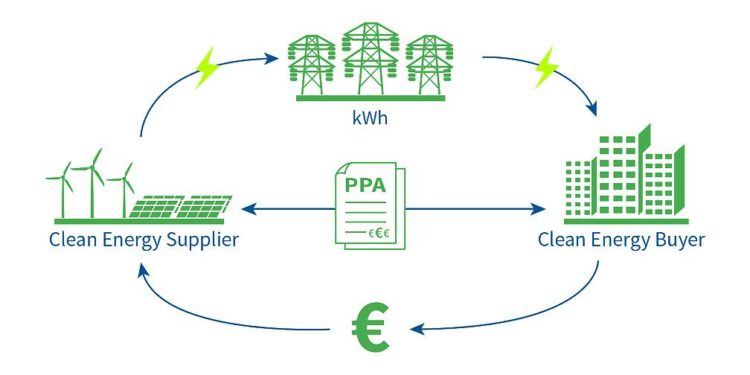

Sumitomo Corporation has announced the extension of its Power Purchase Agreement (PPA) in the United Arab Emirates (UAE) for an additional 15 years, marking a significant milestone in the region’s renewable energy sector. This extension underscores the company’s commitment to long-term sustainable energy solutions and reinforces its strategic presence in the UAE’s rapidly evolving power market. The renewed agreement is expected to facilitate continued investment in clean energy infrastructure, supporting the UAE’s ambitious goals for carbon reduction and energy diversification.

Extension of Power Purchase Agreement in UAE Signals Long-Term Energy Stability

The recent renewal of the power purchase agreement in the UAE for an additional 15 years represents a significant milestone in the nation’s commitment to energy security and sustainable growth. This extension not only guarantees a stable and predictable revenue stream for energy producers but also reinforces the country’s strategic vision to maintain a robust energy infrastructure amid rising demand. By locking in long-term power procurement terms, the UAE is creating a favorable environment for continued investment in renewable projects and cutting-edge technologies.

Key benefits of this extension include:

- Enhanced grid reliability and resilience to support rapid urban development

- Increased investor confidence fostering growth in green energy sectors

- Aligned incentives for energy efficiency and emissions reductions

- Stable pricing structures that benefit both consumers and stakeholders

| Aspect | Impact | Duration |

|---|---|---|

| Contract Term | Long-term stability | 15 Years |

| Investment Boost | Renewable energy projects | Ongoing |

| Energy Security | Reliable supply | Extended period |

Key Implications of the 15-Year Extension for Renewable Energy Investments

The decision to extend the Power Purchase Agreement (PPA) by 15 years marks a significant milestone for renewable energy stakeholders in the UAE. This extension not only provides a prolonged guarantee of revenue for developers and investors but also strengthens the viability of green energy projects amid a global push towards decarbonization. With a secured market over a longer horizon, investors are likely to witness improved project financing terms, reduced risk premiums, and accelerated deployment of innovative technologies in solar and wind sectors.

Furthermore, the extended contract period encourages diversified investment strategies and enhances confidence in the UAE’s renewable market. Key implications include:

- Greater project bankability: Longer contract duration stabilizes cash flow projections, easing access to capital.

- Increased competitiveness: Investors can leverage economies of scale and reduce levelized cost of electricity (LCOE).

- Boosted innovation: Extended timelines incentivize R&D focused on efficiency and storage solutions.

- Strengthened policy signals: The government’s commitment signals opportunities for further private-sector engagement.

| Implication | Expected Impact |

|---|---|

| Financial Stability | Improved investor confidence and capital inflow |

| Technological Advancements | Increased funding for solar/storage innovation |

| Market Expansion | Opportunity for new entrants and project scaling |

Strategic Recommendations for Stakeholders Amidst the Prolonged Agreement

Stakeholders are advised to recalibrate their operational and financial frameworks in light of the extended Power Purchase Agreement. Long-term contractual certainty offers a unique opportunity to enhance investment in infrastructure and optimize asset management strategies. However, it also demands rigorous risk assessment and contingency planning to mitigate market fluctuations and evolving regulatory landscapes. Key actions include:

- Conducting comprehensive scenario analyses to anticipate future energy demand and pricing shifts

- Fortifying partnerships between public and private sectors to leverage technological innovation

- Investing in sustainable practices that align with UAE’s renewable energy agenda

- Establishing dynamic monitoring systems to track performance and compliance over the extended term

Financial stakeholders should consider adjusting their risk models and capital allocation to reflect the new temporal horizon. This includes renegotiating financing terms and exploring new funding mechanisms tailored to long-term infrastructure projects. Below is a simplified framework outlining strategic focus areas for stakeholders:

| Stakeholder Group | Strategic Focus | Recommended Action | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Energy Producers | Maximize asset utilization | Upgrade plant efficiency & adopt digital monitoring | |||||||||

| Investors | Risk management & capital preservation | Diversify portfolios & renegotiate loan terms | |||||||||

| Regulators | Policy stability & compliance monitoring |

Stakeholders are advised to recalibrate their operational and financial frameworks in light of the extended Power Purchase Agreement. Long-term contractual certainty offers a unique opportunity to enhance investment in infrastructure and optimize asset management strategies. However, it also demands rigorous risk assessment and contingency planning to mitigate market fluctuations and evolving regulatory landscapes. Key actions include:

Financial stakeholders should consider adjusting their risk models and capital allocation to reflect the new temporal horizon. This includes renegotiating financing terms and exploring new funding mechanisms tailored to long-term infrastructure projects. Below is a simplified framework outlining strategic focus areas for stakeholders:

|