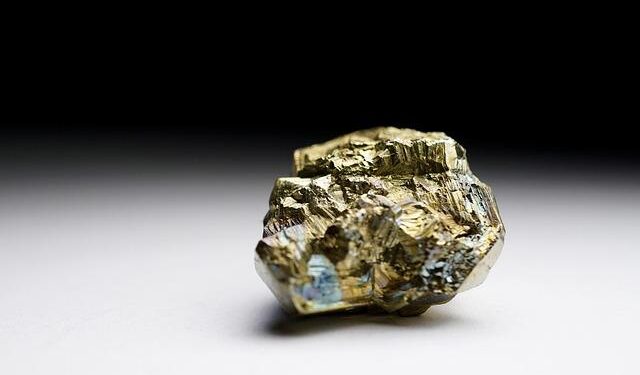

U.S. Eyes Central Asia’s Mineral Riches Amid Crude Oil Price Fluctuations

As global energy markets grapple with volatility and shifting supply dynamics, the United States is increasingly turning its attention to Central Asia—an often overlooked treasure trove of mineral resources. With countries like Kazakhstan, Uzbekistan, and Kyrgyzstan sitting atop vast reserves of precious metals, rare earth elements, and hydrocarbons, U.S. interests are exploring new avenues for collaboration and investment in this strategically vital region. In the context of rising crude oil prices and growing energy demand, American policymakers and businesses are recalibrating their approach to Central Asia, seeking not only to secure essential resources but also to counterbalance the influence of rival powers. This article delves into the implications of America’s renewed focus on Central Asia’s mineral wealth, the challenges it faces, and the broader context of the global energy landscape.

U.S. strategizes to Secure Central Asia’s Mineral Wealth Amid Global Energy shifts

As global energy dynamics continue to evolve, the U.S.is intensifying its efforts to secure vital mineral resources in Central Asia. This region is increasingly recognized not only for its rich deposits of minerals like lithium, cobalt, and rare earth elements but also for its strategic importance in geopolitical planning and energy security. Amidst the backdrop of fluctuating crude oil prices and shifting demand towards greener alternatives, the U.S. aims to foster partnerships with the Central Asian republics to ensure a steady supply of these essential materials that are critical for renewable energy technologies and various high-tech applications. Key strategies include:

- Enhancing diplomatic ties with Central Asian nations.

- Pursuing investment opportunities in mining and energy infrastructure.

- Collaborating on technology transfers and capacity-building initiatives.

The growing competition from China, wich has already made significant inroads into the region’s mining and energy sectors, underscores the urgency for U.S. involvement. By solidifying its influence, the U.S. can safeguard its interests while potentially contributing to the economic development of Central Asian nations. Furthermore,the transition towards a low-carbon economy places added emphasis on securing these mineral resources,as they play a vital role in the production of batteries and renewable energy technologies. A recent analysis highlights the following mineral reserves in the region:

| Mineral Type | Countries of Interest | Approx. reserves (in metric tons) |

|---|---|---|

| Lithium | Kazakhstan, Kyrgyzstan | 200,000 |

| Cobalt | Uzbekistan | 50,000 |

| Rare Earth Elements | Tajikistan, Kazakhstan | 1,000,000 |

As the U.S. navigates this complex landscape, it is indeed becoming increasingly evident that engagement in Central Asia’s mineral wealth could redefine not just energy policies, but also aid in the larger goal of sustainable development and strategic independence in the global marketplace.

Impact of Crude oil Prices on U.S. Interests in Central Asia’s Resource Market

The fluctuations in crude oil prices have far-reaching implications for U.S. interests in Central Asia’s resource market, a region rich in minerals and hydrocarbons. As oil prices soar or plummet, they directly influence the economic stability and investment attractiveness of Central Asian nations, which are key players in global energy supply chains. Notably, when oil prices are high, countries in this region are more likely to invest in infrastructure and development projects, enhancing their appeal to U.S. companies seeking to secure long-term partnerships and access to critical resources.Conversely, significant drops in prices can lead to budgetary constraints for these nations, potentially destabilizing their economies and jeopardizing U.S. investments.

Moreover, the geopolitical landscape is affected by changes in crude oil pricing, as U.S. allies and competitors vie for influence in these mineral-rich territories. The United States’ ability to navigate relationships with Central Asian governments hinges on its diplomatic engagement and strategic economic partnerships, which are influenced by the prospect of profit amid fluctuating oil markets. The key considerations include:

- Investment Opportunities: Higher oil prices can trigger a surge in exploratory drilling and mining activities.

- Geopolitical Engagement: The U.S. may strengthen alliances with Central Asian countries to counteract the influence of other powers such as Russia and China.

- Resource Security: Securing access to minerals and energy resources becomes critical as global energy demands grow.

Recommendations for Strengthening U.S.Presence and Partnerships in Central Asia’s Energy Sector

To fortify its foothold in Central Asia’s burgeoning energy landscape, the U.S. must prioritize multifaceted engagement strategies that foster collaborative partnerships. Key actions could comprise:

- Investment in Infrastructure: Mobilizing financial resources to enhance pipelines, refineries, and energy storage facilities will boost production efficiency and deliver security against geopolitical uncertainties.

- Joint Ventures with Local Companies: Encouraging public-private partnerships with local firms can ensure knowledge transfer and technology sharing, reinforcing the U.S. commitment to sustainable energy practices.

- Training and Development Programs: Offering training initiatives for local engineers and technicians will build local capacity and create a skilled workforce adept in contemporary energy technologies.

Moreover, deepening diplomatic dialogues is essential for establishing trust and mutual benefits. Steps to consider include:

- Regular Energy Forums: Hosting annual energy summits that bring together Central Asian nations and U.S. stakeholders can facilitate discussions on regional energy policies and strategic collaborations.

- Regional Security Collaborations: Engaging in security dialogues focused on protecting energy infrastructure from external threats is crucial for ensuring uninterrupted energy flow.

- Exploration of Renewable Energy Projects: Expanding U.S. initiatives into renewable energy sources such as solar and wind can diversify the region’s energy portfolio and highlight American technological advancements.

Wrapping Up

as the global demand for energy resources continues to escalate amidst geopolitical shifts, Central Asia emerges as a pivotal player on the world stage. With its vast reserves of minerals and hydrocarbons,the region not only attracts the attention of the U.S. but also holds strategic importance for energy security and economic development. As crude oil prices fluctuate and the push for sustainable energy intensifies, the interplay between U.S. interests and Central Asia’s mineral wealth will undoubtedly shape future geopolitical dynamics. Stakeholders—the governments of Central Asia, the U.S. governance, and energy companies—must navigate this intricate landscape with a focus on cooperation, sustainable practices, and mutual benefit. The coming years promise to be significant as central Asia’s resources are further explored and leveraged,potentially altering the trajectory of global energy markets. For ongoing updates and insights into this evolving situation, stay tuned to OilPrice.com.