Introduction:

As one of Southeast Asia’s most rapidly developing economies, Vietnam stands out as a beacon of prospect for investors looking to tap into the region’s dynamic growth. With a population that boasts a youthful workforce and an increasingly sophisticated consumer base, the country has transformed from a war-torn nation into a thriving market characterized by resilient economic policies and a commitment to reform. While its communist government may evoke images of rigid control, Vietnam has embraced market-oriented strategies that have propelled it into the global economic spotlight. In this article, we will explore the best ways to invest in Vietnam, delving into key sectors, emerging trends, and the potential obstacles investors may face in this vibrant and evolving landscape. Whether you’re a seasoned investor or exploring new frontiers, understanding the intricacies of Vietnam’s economy is essential to unlocking the potential that this Asian dynamo has to offer.

Understanding Vietnam’s Economic Landscape

Vietnam’s economic landscape has undergone significant transformation over the past few decades, evolving from a centrally planned economy to a vibrant market-oriented system. this shift has positioned the country as one of Asia’s most appealing investment destinations, characterized by its dynamic workforce, strategic location, and government initiatives aimed at fostering growth. Key sectors attracting foreign investments include:

- Manufacturing: The backbone of Vietnam’s economy, particularly in textiles, electronics, and automotive.

- Agriculture: With vast natural resources, Vietnam is a leading exporter of rice, coffee, and seafood.

- Technology: A burgeoning tech industry focusing on software development,startups,and digital services.

- Tourism: With its rich cultural heritage, Vietnam sees millions of international visitors annually.

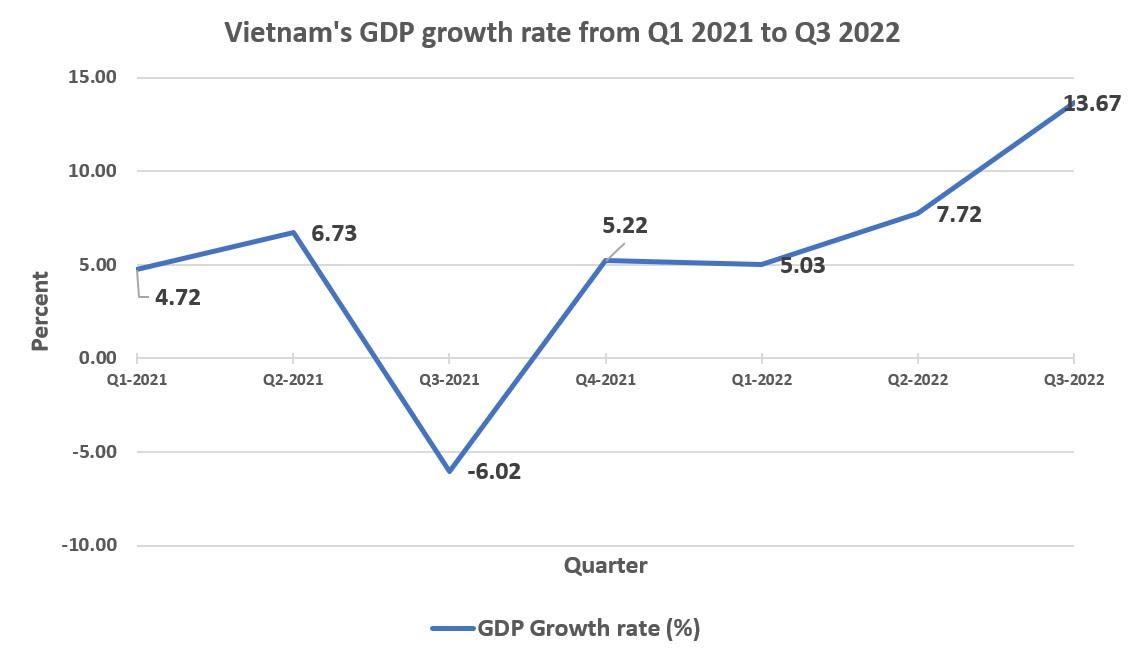

Furthermore, the Vietnamese government has implemented several reforms to enhance the business climate, including tax incentives and the establishment of special economic zones. These efforts contribute to a robust infrastructure, with ongoing investments in transportation and energy sectors that facilitate trade and connectivity. To illustrate the potential for growth, consider the following table showcasing projected GDP growth rates:

| Year | Projected GDP Growth (%) |

|---|---|

| 2023 | 6.2 |

| 2024 | 6.5 |

| 2025 | 6.7 |

The positive economic indicators, coupled with a youthful population and increasing consumer spending, suggest that Vietnam is not just a passing trend but a formidable force in the Asian economic landscape. Investors looking to tap into this potential are met with a landscape that is both promising and ripe for exploration.

Key Sectors Driving vietnam’s Growth Potential

Vietnam’s economic landscape is characterized by several vibrant sectors that are poised for significant growth in the coming years. Manufacturing stands out as a cornerstone of this expansion, fuelled by the country’s competitive labor force and increasing foreign direct investment.With governments and companies drawn to its thriving supply chain, Vietnam’s textile and apparel industry is rapidly evolving, providing opportunities for international investors. Furthermore, the rise of technology and innovation cannot be ignored, as the nation emerges as a key player in the global tech arena, particularly in software development and IT services.

Additionally, the tourism sector plays a crucial role in promoting economic growth, thanks to Vietnam’s stunning landscapes and rich cultural heritage that attract millions of visitors annually. Notably, with government initiatives aimed at enhancing infrastructure, there is immense potential for businesses in real estate and hospitality. Other sectors such as agriculture, driven by modernization and the adoption of technology, are also becoming more efficient, offering a lucrative avenue for investment. As these industries continue to flourish, they contribute significantly to Vietnam’s journey toward becoming a dynamic economic power in Asia.

Investment Vehicles for Foreign Investors

Vietnam presents an array of investment opportunities for foreign investors, ranging from real estate to various financial instruments. One of the most appealing options involves real estate investment trusts (REITs), which allow investors to gain exposure to the booming property market without the need to directly purchase real estate. Additionally, foreign direct investment (FDI) is a significant avenue, where investors can establish wholly-owned enterprises or joint ventures to tap into the rapidly growing domestic market. Other financial products, such as government bonds and corporate bonds, also offer stability and potential returns that can attract those looking to diversify their portfolios.

When selecting an investment vehicle, it’s essential to understand the local regulatory landscape. Key factors to consider include the ease of doing business, the legal framework surrounding foreign investments, and potential tax incentives. The following table outlines some popular investment vehicles along with their characteristics:

| Investment Vehicle | Characteristics | Potential Benefits |

|---|---|---|

| REITs | Trade on stock exchanges; exposure to real estate | Liquidity and dividend income |

| FDI | Establish business operations in Vietnam | Access to local markets and resources |

| Bonds | Issued by government or corporations | Stable returns; lower risk |

Navigating Regulatory Challenges in Vietnam

navigating the complex regulatory landscape in Vietnam requires a keen understanding of the local laws and business practices. investors must be aware of various regulations that influence foreign direct investment (FDI), taxation, and ownership structures.A strong grasp of these factors can prevent potential pitfalls and enhance the chances of accomplished market entry. Essentials to consider include:

- Foreign Ownership Limits: Understanding the caps on foreign ownership in specific sectors is crucial.

- Investment Registration: All foreign investments must be registered with relevant authorities, underlining the importance of compliance.

- Tax Incentives: Familiarity with available incentives can provide significant benefits in the long term.

- Local Partnerships: Collaborating with local businesses can ease the regulatory burden and enhance market insights.

Engaging legal and financial advisors who specialize in Vietnamese regulations is highly advisable. These experts can offer insight into navigating compliance issues and optimizing investment strategies. Additionally,establishing a robust local presence will not only facilitate smoother operations but also demonstrate commitment to local stakeholders. An vital aspect to consider includes:

| Aspect | Importance |

|---|---|

| Legal Compliance | Minimizes risks of penalties and operational disruptions |

| Market Research | Informs strategy and identifies opportunities |

| Community Engagement | Builds trust and facilitates smoother operations |

Harnessing Technology and Innovation in Vietnam’s markets

In recent years, Vietnam has rapidly positioned itself as a hotbed for technological advancement and innovation, making it an attractive destination for savvy investors. the country is leveraging its young and tech-savvy population to drive growth in sectors like e-commerce, FinTech, and information technology.Vietnam has become home to numerous startups, many of which are solving local issues while also eyeing international markets. Noteworthy trends include the rise of cashless payment systems and the proliferation of online marketplaces, which have redefined consumer behavior. The government’s commitment to digital transformation, as embodied by the Vietnam Digital Transformation Program 2025, further illustrates the potential for investment in a nation reinvigorated by technology.

Moreover, Vietnam’s investment in infrastructure projects plays a crucial role in fostering innovation. Facilities like tech parks and incubators are sprouting across major cities, facilitating collaboration between businesses and fostering an environment ripe for breakthroughs. Prominent sectors that are adapting well to this landscape include:

- Green Technology: Solutions that address environmental challenges, appealing to global eco-conscious investors.

- Agritech: Innovations aimed at enhancing agricultural output and sustainability.

- Education Technology: platforms designed to improve access to quality education in rural areas.

These sectors not only represent lucrative investment opportunities but also contribute to the nation’s socio-economic development, ensuring that investors can engage with Vietnam’s markets while promoting sustainable growth.

Strategies for Long-Term Investment Success in Vietnam

To achieve sustainable growth in Vietnam’s burgeoning market, investors should prioritize diversification across sectors such as technology, consumer goods, and infrastructure. The country’s rapid economic development, fueled by increasing foreign direct investment and a burgeoning middle class, presents numerous opportunities. Key strategies include:

- Investing in Local Enterprises: Focusing on companies with strong local networks can provide insights into market trends and consumer behavior.

- Staying Informed on Regulatory Changes: Understanding the evolving legal landscape is crucial to mitigate risks associated with government policies.

- Utilizing Technology: Leveraging fintech and digital platforms can enhance investment efficiency and openness.

Additionally, it’s essential to conduct thorough market research to identify emerging sectors and evaluate the long-term growth potential of various companies. Investors may benefit from forming partnerships with local firms or consulting with reputable financial advisors who understand the intricacies of the Vietnamese market. This localized expertise can translate into sound investment decisions. For a clearer picture of sector performance, consider the following table:

| Sector | Growth Potential (%) | Investment Risk Level |

|---|---|---|

| Technology | 15-20 | Medium |

| Consumer Goods | 10-15 | Low |

| Infrastructure | 12-18 | High |

In Retrospect

Vietnam stands out as an intriguing investment destination within the Asian landscape, combining robust economic growth with a unique socio-political backdrop. As we explored in this article, various avenues such as real estate, manufacturing, and technology present significant opportunities for both local and foreign investors. The government’s commitment to economic reform and integration into global markets further enhances its appeal.

However, potential investors must remain vigilant and conduct thorough due diligence, considering the regulatory environment and geopolitical factors that could influence their decisions. By balancing risk and reward,investors can effectively tap into the potential of this communist dynamo and contribute to the shaping of its vibrant economy. Ultimately, as Vietnam continues to develop, those who seize the moment may find themselves at the forefront of one of Asia’s most compelling investment stories.