China’s crude oil imports from Russia and Malaysia experienced a significant decline in August, reflecting shifting supply dynamics in the world’s largest energy market. Meanwhile, for the third consecutive month, China reported no shipments from the United States, underscoring ongoing changes in trade flows amid evolving geopolitical and economic conditions. This development signals a potential recalibration of China’s crude sourcing strategy as global energy markets continue to adjust to recent disruptions.

China’s Crude Imports from Russia and Malaysia See Significant Decline in August

China’s crude oil imports experienced a notable shift in August as shipments from Russia and Malaysia saw a marked downturn. Industry data revealed that imports from Russia, one of China’s top suppliers, declined by nearly 15% compared to the previous month. Similarly, deliveries from Malaysia dropped sharply, signaling a potential realignment in China’s sourcing strategy amidst evolving geopolitical and market dynamics. Analysts suggest that tariff adjustments and changing demand patterns within China’s refining sector could be driving this retraction.

Key highlights of China’s crude oil imports in August include:

- Russian crude: Down 15%, affected by logistic constraints and pricing competition.

- Malaysian crude: Experienced a 20% decline amid shifts to alternative suppliers.

- U.S. crude: Remained absent for the third consecutive month, continuing the trade lull between the two countries.

| Supplier | August Imports (barrels) | Monthly Change |

|---|---|---|

| Russia | 4.8 million | -15% |

| Malaysia | 1.2 million | -20% |

| United States | 0 | 0% |

Impact of Continued Suspension of US Oil Shipments on China’s Energy Market

The prolonged halt in US crude oil shipments to China is exerting significant pressure on the country’s energy supply chain. As American barrels remain absent for the third consecutive month, Chinese importers are forced to recalibrate their sourcing strategies amid fluctuating global prices and geopolitical tensions. This disruption coincides with notable declines in crude arrivals from traditional suppliers Russia and Malaysia, signaling potential challenges ahead for China’s energy security and market stability.

Industry analysts highlight several immediate repercussions of these shifts:

- Price Volatility: Limited diversification in crude imports has driven premiums higher on alternative suppliers, impacting refining costs.

- Supply Chain Risks: Overreliance on fewer sources creates vulnerability to geopolitical disruptions or production cuts.

- Strategic Reserves Pressure: Reduced inflows may compel China to dip into strategic petroleum reserves more frequently to buffer domestic demand.

| Country | August Import Volume (mbpd) | Month-on-Month Change |

|---|---|---|

| Russia | 1.95 | -12% |

| Malaysia | 0.55 | -18% |

| United States | 0 | -100% |

Strategic Recommendations for Diversifying China’s Crude Supply Amid Volatile Imports

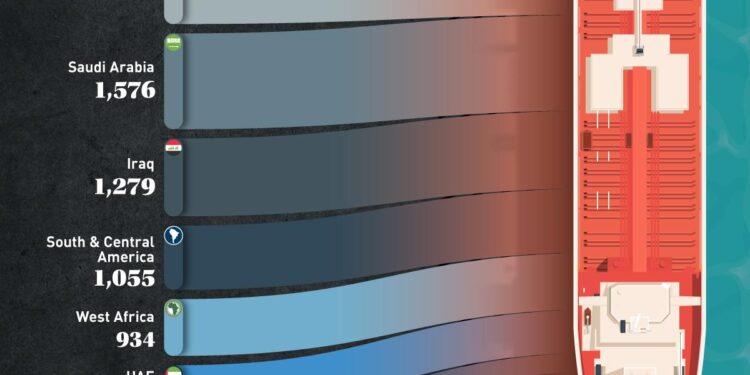

In light of the recent fluctuations in China’s crude oil imports, particularly the sharp decline from Russia and Malaysia coupled with a continued absence of shipments from the US, it is imperative for China to adopt a multi-faceted approach to diversify its crude supply chain. Strengthening ties with alternative suppliers in the Middle East, Africa, and Latin America can mitigate geopolitical risks and reduce overreliance on any single source. Additionally, enhancing domestic refining capabilities to process a wider variety of crude grades will enable China to absorb diverse shipments more efficiently, ensuring steady supply despite market volatility.

Key strategic considerations include:

- Expanding partnerships with reliable suppliers such as Saudi Arabia, Iraq, and Angola to balance the decline in Russian and Malaysian volumes.

- Investing in infrastructure to support incremental imports from smaller producers and new trade corridors, including maritime and pipeline routes.

- Leveraging strategic reserves to buffer short-term supply shocks while negotiations with alternative vendors are underway.

- Exploring sustainable alternatives to crude imports by boosting investments in liquefied natural gas (LNG) and renewable energy sources.

| Supplier Region | Current Share | Potential Growth Opportunities |

|---|---|---|

| Middle East | 40% | High – stable output and long-term contracts |

| Africa | 15% | Medium – increasing exports with infrastructure upgrades |

| Latin America | 10% | Low – logistical challenges but untapped reserves |

| Russia | 20% | Volatile – subject to geopolitical risk |

| US | 0% | Uncertain – sanctions and policy shifts |

Final Thoughts

As China’s crude imports from Russia and Malaysia declined sharply in August, and shipments from the United States remained absent for a third consecutive month, market observers will be closely watching how these shifts affect global oil dynamics in the coming months. The evolving trade patterns underscore the ongoing adjustments within China’s energy sourcing strategies amid geopolitical and economic pressures. Further developments in supply routes and bilateral relations will likely play a critical role in shaping the future landscape of crude oil imports into the world’s largest energy consumer.