Indonesia’s unexpected decision to slash interest rates in a bid to stimulate economic growth has sent ripples through currency markets, placing the rupiah squarely in the spotlight. In a move that caught analysts off guard, the central bank’s rate cut aims to accelerate domestic expansion amid a challenging global backdrop. However, the policy shift has also raised concerns among investors about inflation and capital outflows, intensifying volatility around Southeast Asia’s third-largest economy. This article examines the implications of Indonesia’s bold growth gambit and the pressures mounting on the rupiah in the wake of the surprise monetary easing.

Indonesia’s Unexpected Rate Cut Sparks Market Volatility and Investor Concerns

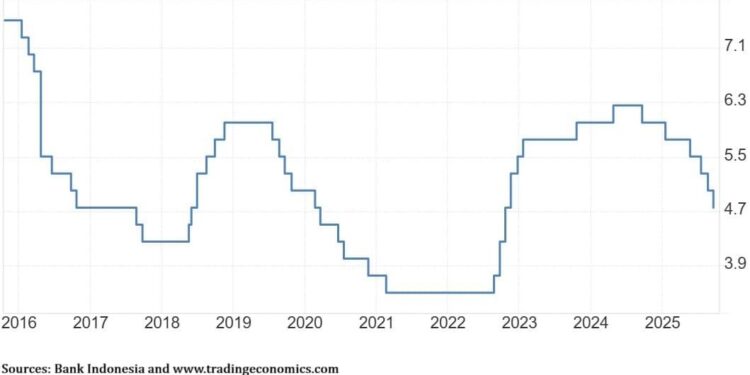

Indonesia’s central bank delivered an unexpected policy rate cut this week, aiming to stimulate the slowing economy amid global uncertainties. While the move was designed to boost domestic growth and encourage lending, it immediately unsettled investors, triggering notable fluctuations in the rupiah’s value. Market participants quickly reacted to the divergence from widely anticipated monetary tightening measures, raising concerns about potential capital outflows and inflationary pressures. The abrupt decision also ignited debates over the long-term efficacy of monetary easing in a fragile economic environment where external shocks remain a significant threat.

Key market indicators now reflect heightened volatility as traders reassess risk exposure associated with Indonesian assets. Analysts point to several factors exacerbating concerns:

- Currency depreciation risks amid already weakening rupiah trends

- Increased uncertainty in emerging market capital flows

- Potential rise in inflation complicating the central bank’s policy outlook

- Investor skepticism regarding the durability of the growth rebound

| Indicator | Before Rate Cut | After Rate Cut |

|---|---|---|

| USD/IDR Exchange Rate | 14,500 | 14,720 |

| Inflation Expectation | 3.8% | 4.2% |

| Benchmark Rate | 5.75% | 5.50% |

Economic Growth Strategy Faces Scrutiny as Rupiah Comes Under Pressure

Indonesia’s recent monetary policy pivot, marked by a surprise rate cut, has sparked concern among investors and analysts alike. The move, aimed at stimulating growth amid slowing global demand, has inadvertently intensified pressure on the rupiah. Despite the government’s optimistic outlook, the currency’s swift depreciation underscores the delicate balance between encouraging economic expansion and maintaining financial stability. Key factors contributing to the currency’s vulnerability include:

- Global market volatility: Ongoing geopolitical tensions have driven risk aversion, leading foreign investors to pull back from emerging markets.

- Inflationary risks: The rate cut raises questions about the central bank’s ability to keep inflation in check over the medium term.

- Capital outflows: Heightened uncertainty has triggered modest capital flight, further straining the rupiah’s value.

Economic data released last week paints a mixed picture that complicates policy responses. While manufacturing growth showed resilience, consumer spending weakened more than expected, raising alarms about the pace of recovery. Below is a snapshot comparison of critical economic indicators pre- and post-rate cut:

| Indicator | Before Rate Cut | After Rate Cut |

|---|---|---|

| Inflation Rate | 3.5% | 3.7% |

| Manufacturing PMI | 51.2 | 50.9 |

| Consumer Confidence Index | 92.4 | 88.1 |

| Rupiah/USD Exchange Rate | 14,800 | 15,200 |

Policy Recommendations Urge Balanced Approach to Support Growth Without Undermining Currency Stability

Economists and market analysts alike emphasize the necessity of a measured policy response to ensure Indonesia’s economic growth ambitions do not come at the expense of currency stability. While the central bank’s surprise rate cut aims to stimulate domestic demand, experts warn this approach could amplify capital outflows and increase the rupiah’s vulnerability amid global financial uncertainties. A strategic blend of monetary tightening and targeted fiscal stimulus is advised to maintain investor confidence while bolstering economic momentum.

Key recommendations from policy experts include:

- Implementing macroprudential measures to curb excessive currency volatility

- Strengthening foreign exchange reserves to serve as a buffer against shocks

- Enhancing transparency in communication to manage market expectations

- Maintaining coordination between monetary and fiscal authorities

| Policy Aspect | Recommended Action | Expected Impact |

|---|---|---|

| Monetary Policy | Selective rate adjustments | Control inflation while encouraging lending |

| Fiscal Policy | Targeted infrastructure spending | Boost growth without overheating economy |

| Currency Management | Reserve build-up | Enhance rupiah resilience |

Key Takeaways

As Indonesia navigates the delicate balance between stimulating growth and managing currency stability, the rupiah remains under close watch from investors and policymakers alike. The unexpected rate cut underscores Jakarta’s commitment to bolstering economic momentum amid global uncertainties, but it also raises questions about potential vulnerabilities in the currency’s outlook. Market participants will be monitoring forthcoming policy moves and economic data closely to gauge the sustainability of this growth-driven approach.