Iraq has significantly increased its crude oil exports following OPEC’s decision to ease production cuts, signaling a strategic move to capitalize on improving market conditions. As the Organization of the Petroleum Exporting Countries begins to roll back previous curbs aimed at stabilizing prices, Iraq is ramping up output to boost revenue and reinforce its position in the global energy landscape. This development comes amid ongoing fluctuations in crude oil prices, influencing supply dynamics and investor sentiment worldwide.

Iraq Accelerates Oil Supply to Capitalize on Eased OPEC Production Limits

Iraq has swiftly increased its oil shipments following OPEC’s recent decision to relax production quotas. The country’s state oil marketer, SOMO, confirmed a sharp rise in export volumes, aiming to capitalize on stronger global demand and higher prices. Iraqi officials have stressed their commitment to restoring output levels that had been constrained over the past year due to OPEC+ cut agreements, signaling a strategic move to boost national revenue amid ongoing economic challenges.

Key highlights of Iraq’s revised oil production stance include:

- Increase in daily crude exports: Up by approximately 300,000 barrels compared to previous months.

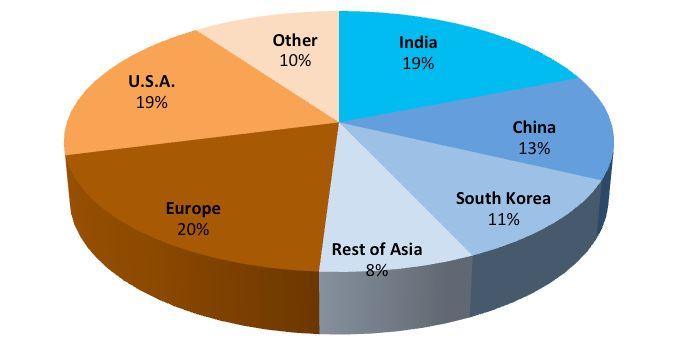

- Focus on Asian markets: With major buyers like China and India increasing crude imports.

- Enhanced logistics: Upgraded port facilities to streamline export operations and cut turnaround times.

| Export Region | Volume (bpd) | Change (%) |

|---|---|---|

| Asia | 2,200,000 | +15% |

| Europe | 800,000 | +5% |

| North America | 400,000 | +8% |

Market Implications of Iraq’s Increased Exports on Global Crude Prices

Iraq’s decision to ramp up oil exports amid OPEC’s move to ease production cuts is poised to send ripples across global crude markets. By increasing its output, Iraq is effectively expanding supply at a time when buyers have been bracing for tighter market conditions. This surge contributes to a shift in market sentiment, exerting downward pressure on benchmark prices such as Brent and WTI. Traders and analysts are recalibrating their forecasts, factoring in the potential for oversupply, especially given Iraq’s sizeable production capacity and strategic position within OPEC.

Key market implications include:

- Price Volatility: Increased Iraqi exports could lead to short-term price fluctuations as markets absorb additional volumes.

- OPEC Policy Signals: The move may embolden other members to follow suit, potentially weakening collective supply discipline.

- Global Inventory Impact: Higher crude influx could swell inventories in storage hubs, influencing futures premiums.

- Regional Shifts: Middle Eastern crude streams may face competition, impacting regional market share.

| Metric | Pre-Increase | Post-Increase | Change (%) |

|---|---|---|---|

| Iraq Exports (mb/d) | 3.7 | 4.2 | 13.5% |

| Brent Price (USD/bbl) | 75.60 | 72.30 | -4.35% |

| Global Inventory (mb) | 2950 | 2985 | 1.19% |

Strategic Recommendations for Traders Navigating the Shifting Oil Market Dynamics

Traders must remain agile amid Iraq’s surge in oil exports combined with OPEC’s rollback of the previous production cuts. This recalibration has shifted supply dynamics, pressuring crude prices but also creating fresh opportunities for short-term gains. Monitoring geopolitical developments in the Middle East, particularly Iraq’s export policy shifts, is essential to anticipate supply fluctuations. Additionally, leveraging technical analysis tools can help identify critical support and resistance levels as the market reacts to these new fundamentals.

- Hedge positions wisely to manage volatility risks introduced by sudden changes in OPEC’s output strategies.

- Consider diversifying exposure across different crude benchmarks like Brent and WTI for balanced risk.

- Stay alert to inventory reports and global demand indicators which will heavily influence price direction in the near term.

| Factor | Impact on Trading | Recommended Action |

|---|---|---|

| Iraq Export Increase | Rising supply pressure | Short-term sell opportunities |

| OPEC Cut Rollback | Supports price rebound potential | Watch for entry points on pullbacks |

| Global Demand Trends | Volume-driven price swings | Adjust positions to market sentiment |

In this environment, the key for traders is maintaining flexibility and employing a combination of fundamental and technical approaches. Real-time data flows, including production reports and global economic activity metrics, will become vital intelligence for making informed trade decisions. Ultimately, those who adapt quickly to Iraq’s export increases and OPEC’s evolving policy stance stand to capitalize on the emerging price volatility in the crude oil market.

In Conclusion

As Iraq ramps up its oil exports following OPEC’s decision to roll back production cuts, the global energy landscape is poised for notable shifts. Market watchers will be closely monitoring how increased supply from Iraq and other members influences crude oil prices in the coming weeks. With demand dynamics still in flux amid economic uncertainties, the interplay between OPEC’s strategic adjustments and market response will remain a critical factor shaping the outlook for the oil industry.